Priority Investment Incentive

These investments have been determined as investments to be made in the identified areas, especially for the purpose of producing high-tech products and encouraging the production of products that have to be imported from abroad in our country.

Achieve your investment goals with the right incentive selection

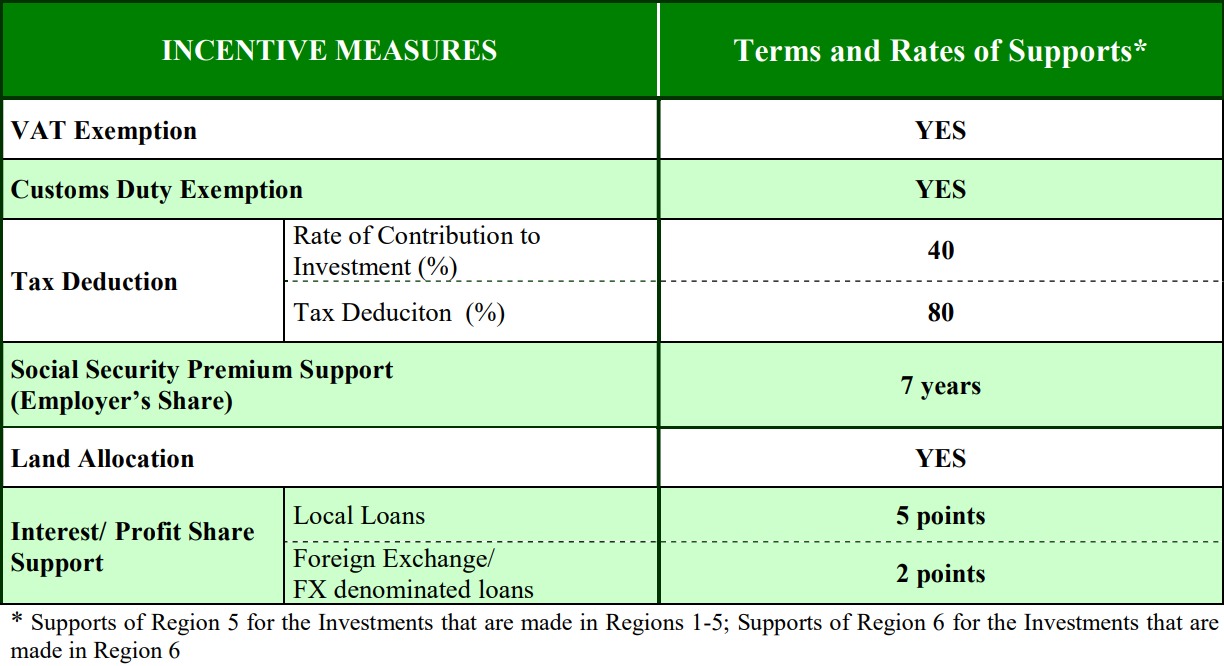

Even if the investment for which a priority investment incentive certificate is obtained is made inthe 1st, 2nd, 3rd and 4th Regions, it will benefit from the supports applied inthe 5th Region. If these investments are made inthe 5th and 6th Regions, the supports applied in their own regions will be provided.

Why Investment Incentive Consulting?

Investment incentive consultancy is a critical service to support businesses' strategic growth goals and ensure they obtain maximum benefit from their investments.

A few of the investment topics to be supported with 5th region supportswithin the scope of Priority Investments are as follows:

- Tourism accommodation investments.

- Mining and mineral exploration investments.

- Investments in freight and/or passenger transportation by rail, sea or air.

- Defense industry investments,

- Test center investments for products in the medium-high and high-tech industry class according to the OECD technology intensity definition.

- Investments in the manufacturing of turbines and generators for renewable energy production and the manufacturing of blades used in wind energy production.

- Integrated investments in the production of aluminum flat products using direct cooling slab casting and hot rolling methods.

- Investments in the production of medium-high technology class products of a minimum amount of 500 million TL.

- Minimum 5,000 m² Data center investments of certain standards that meet the white space requirement.

- Investments within the scope of the Digital Transformation Support Program.

- Licensed warehousing investments

End to End Service

Privacy Policy

Customer Focused Approach

How do we help you successfully realize your investment in the shortest time possible?

Preparation and Management of Incentive Application

Management of the Investment Process

Legal and Administrative Support

Our Consulting Process

We offer the best services to help you achieve your investment goals.

Needs Analysis and Goal Setting

Incentive Application and Management of Official Processes

Investment Monitoring and Evaluation Process

Investment Incentive Certificate Closing Application

Frequently Asked Questions.

The most curious topics about investment and incentives

What is the Investment Incentive Certificate?

What advantages can I benefit from with the incentive certificate?

Reducing the costs of your project,

Exemption from customs duty and VAT,

Acceleration of investment with financing support,

SGK premium advantages for employees,

Minimizing tax burdens.

What Does Investment Incentive Certificate Consultancy Include?

Determining the appropriate type of incentive,

Preparing the necessary documents,

Managing the application process,

Post-process reporting and support

Which Documents Are Required for Application?

Identity and authorization documents of the investor,

Feasibility report including project details,

List of machinery and equipment,

Application form,

Financial statement and capital information.

What Processes Should Be Followed After Receiving the Document?

Verification that the investment is progressing within the scope of the incentive,

Requests for extension or revision must be made,

Preparation of the necessary reports for the closure of the document.

Thus, you can fully benefit from all incentives.

At Which Stage Should We Seek Consultation?

What are the conditions for benefiting from incentives?

The investment must be in one of the supported sectors,

The project must comply with the specified regional or sectoral priorities,

Completion of the investment within the period specified in the document.