Project Based Incentive

Project-Based Investment Incentives are the most comprehensive investment support system in our country. They are offered specifically for investments of a minimum of 2 billion TL, technology-intensive, high added value and aimed at reducing import dependency. Aiming to encourage large-scale investments and provide Turkey with an advantage in international competition, this program is designed to facilitate the implementation of important projects.

Maximum Incentive for Your Investment Projects!

The project-based incentive system aims to contribute to the growth of both companies and the national economy by supporting large-scale and strategic investments. The right consultancy service plays a critical role in order to benefit from the most comprehensive incentive according to the scope and sectoral characteristics of your projects.

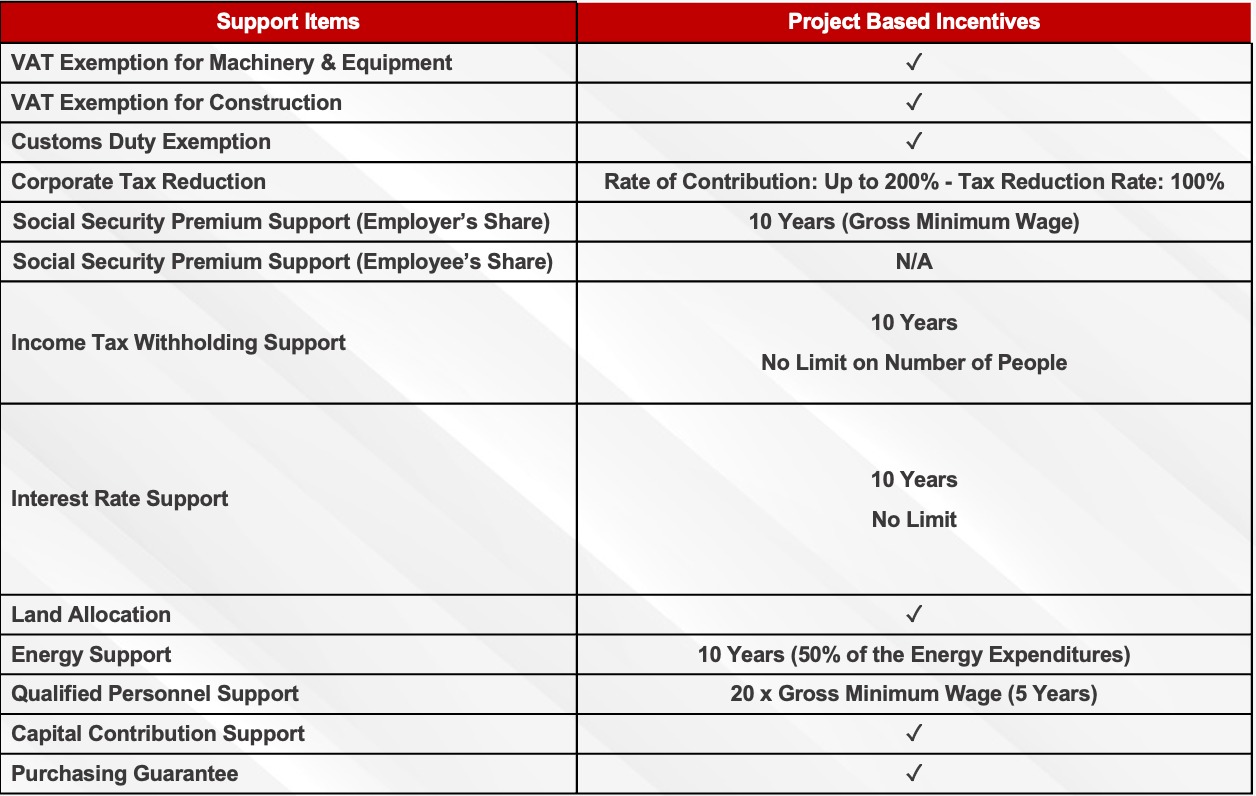

Depending on the characteristics of your project, you can benefit from the following incentives.

We ensure that you benefit from incentives at the maximum level by being with you with our expert team in all processes of your large-scale investment projects. We meticulously manage the project-based incentive application process.

Project Based Incentive Supports

We ensure that you benefit from incentives at the maximum level by being with you with our expert team in all processes of your large-scale investment projects. We meticulously manage the project-based incentive application process.

Investment Project Planning

Incentive Selection and Application Process

Ongoing Support and Reporting

Which Projects Are Included in the Incentive?

Project-based incentives are generally valid for strategically important, innovative and large-scale investments. If your investment projects meet the following criteria, you may have a higher chance of benefiting from incentives:

How do we help you successfully realize your investment in the shortest time possible?

Preparation and Management of Incentive Application

Management of the Investment Process

Legal and Administrative Support

Our Consulting Process

We offer the best services to help you achieve your investment goals.

Needs Analysis and Goal Setting

Incentive Application and Management of Official Processes

Investment Monitoring and Evaluation Process

Investment Incentive Certificate Closing Application

Frequently Asked Questions.

The most curious topics about investment and incentives

What is the Investment Incentive Certificate?

What advantages can I benefit from with the incentive certificate?

Reducing the costs of your project,

Exemption from customs duty and VAT,

Acceleration of investment with financing support,

SGK premium advantages for employees,

Minimizing tax burdens.

What Does Investment Incentive Certificate Consultancy Include?

Determining the appropriate type of incentive,

Preparing the necessary documents,

Managing the application process,

Post-process reporting and support

Which Documents Are Required for Application?

Identity and authorization documents of the investor,

Feasibility report including project details,

List of machinery and equipment,

Application form,

Financial statement and capital information.

What Processes Should Be Followed After Receiving the Document?

Verification that the investment is progressing within the scope of the incentive,

Requests for extension or revision must be made,

Preparation of the necessary reports for the closure of the document.

Thus, you can fully benefit from all incentives.

At Which Stage Should We Seek Consultation?

What are the conditions for benefiting from incentives?

The investment must be in one of the supported sectors,

The project must comply with the specified regional or sectoral priorities,

Completion of the investment within the period specified in the document.